Enter Ethereum Address with AAVE v2 Borrowing Activity

How It Works

This tool uses machine learning to predict the likelihood of liquidation for AAVE v2 users. The system analyzes user borrowing patterns, collateral assets, health factors, and historical activity to calculate a risk score on a scale of 300-850 (similar to a credit score).

The model is trained on historical data from the AAVE protocol, including past liquidation events. Using XGBoost (a gradient boosting algorithm), the system identifies patterns that lead to liquidation and assigns risk levels accordingly.

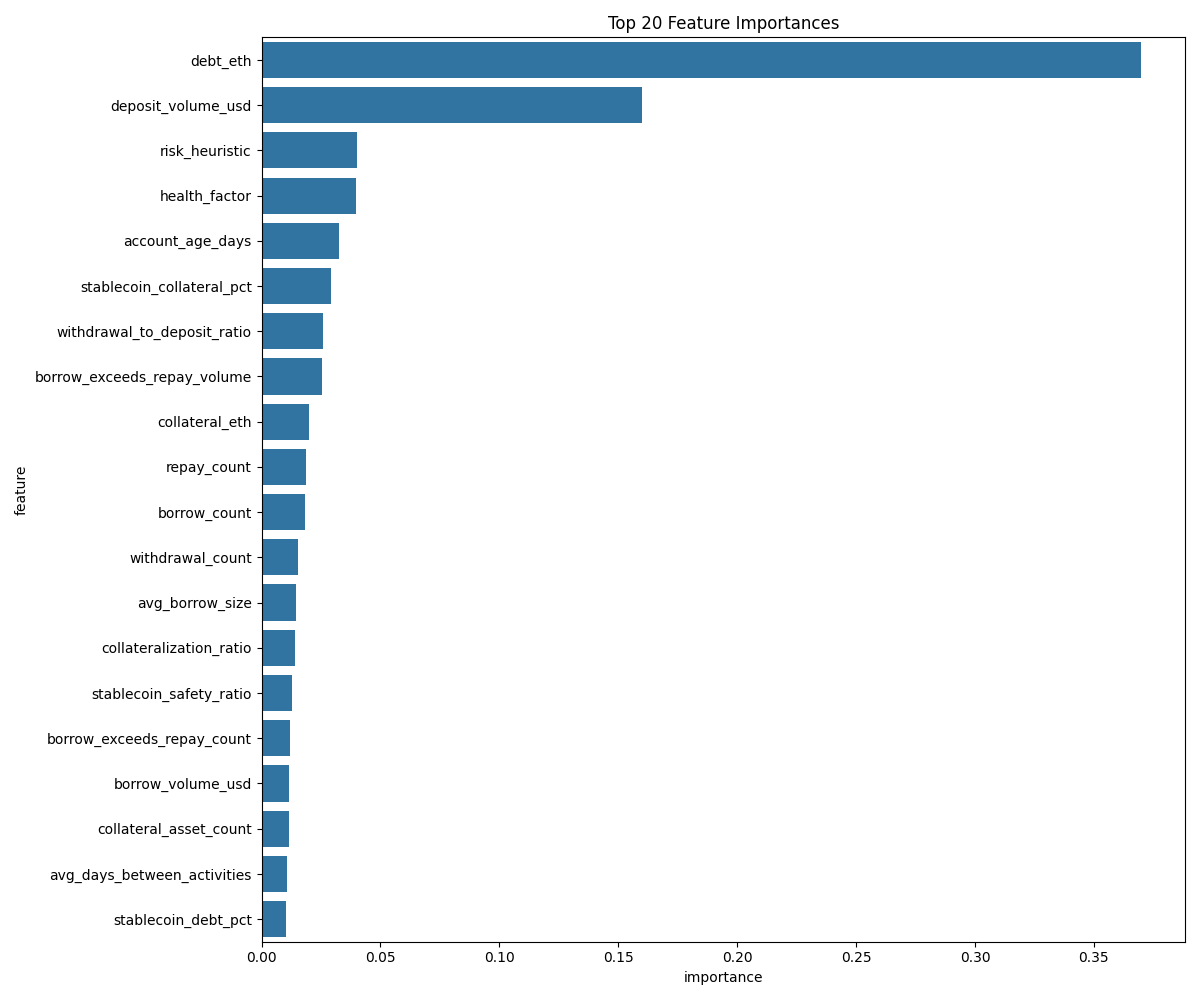

Key Features Used for Prediction

The model analyzes over 30 features, with the most important ones being:

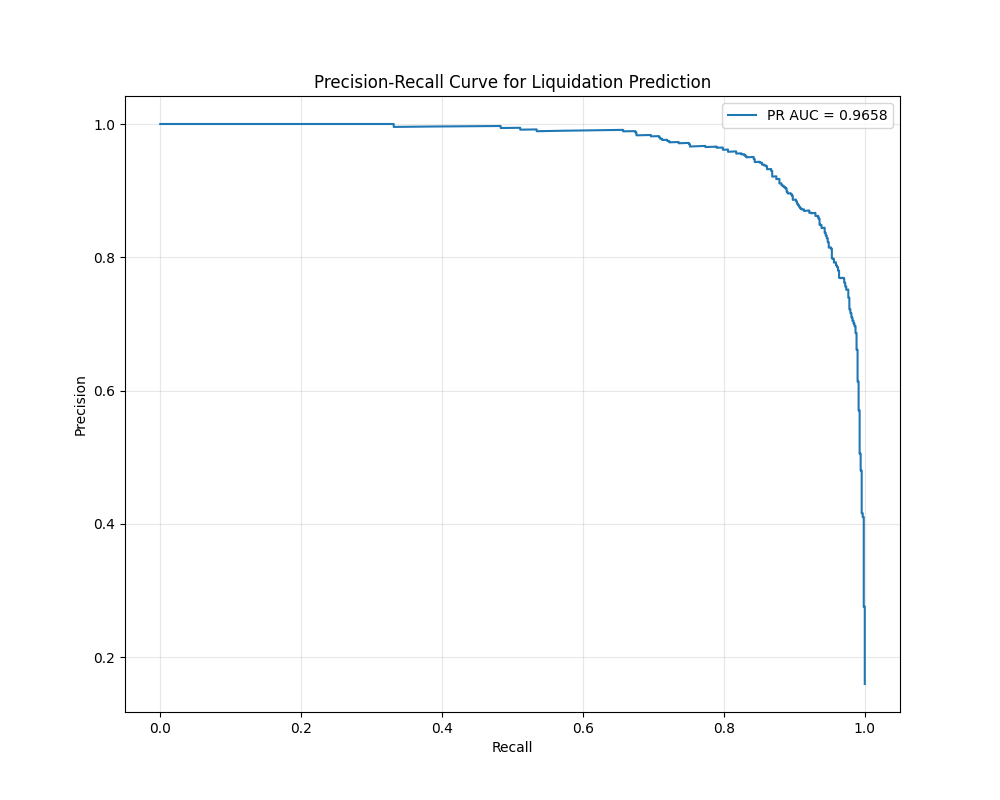

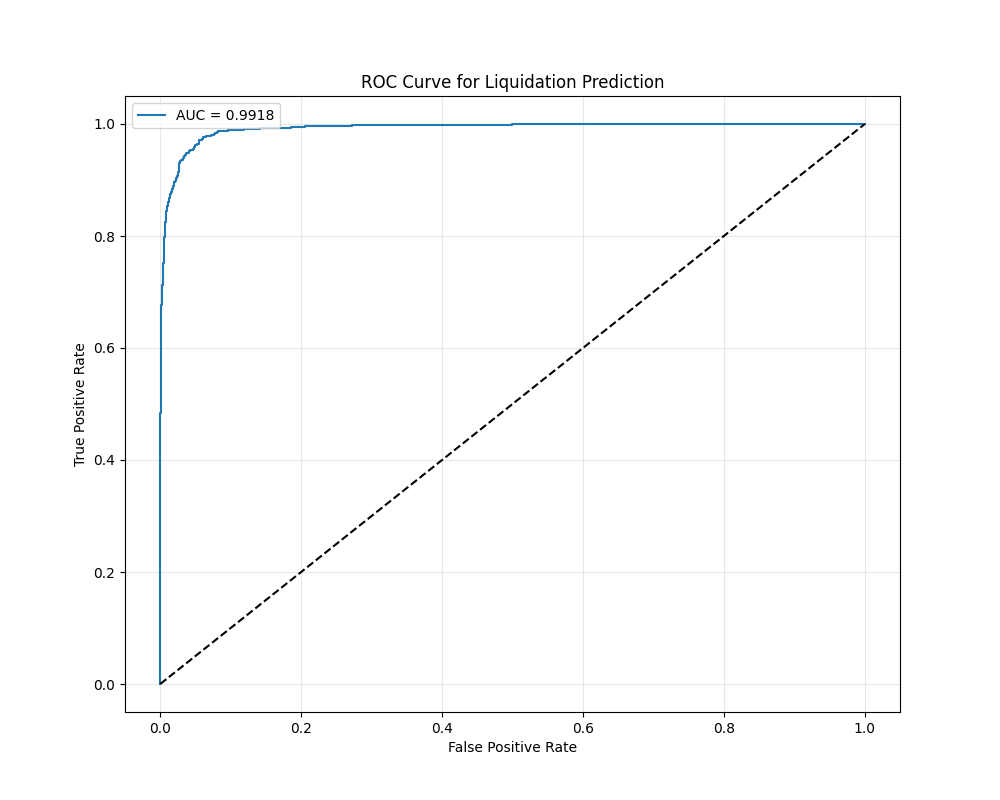

Model Performance

ROC AUC: 0.9918

PR AUC: 0.9658

Algorithm: XGBoost

Class Balancing: SMOTE

Feature Importance

The chart below shows which features have the greatest impact on predicting liquidation risk:

Model Accuracy

The following charts demonstrate the model's predictive performance:

Precision-Recall Curve

ROC Curve